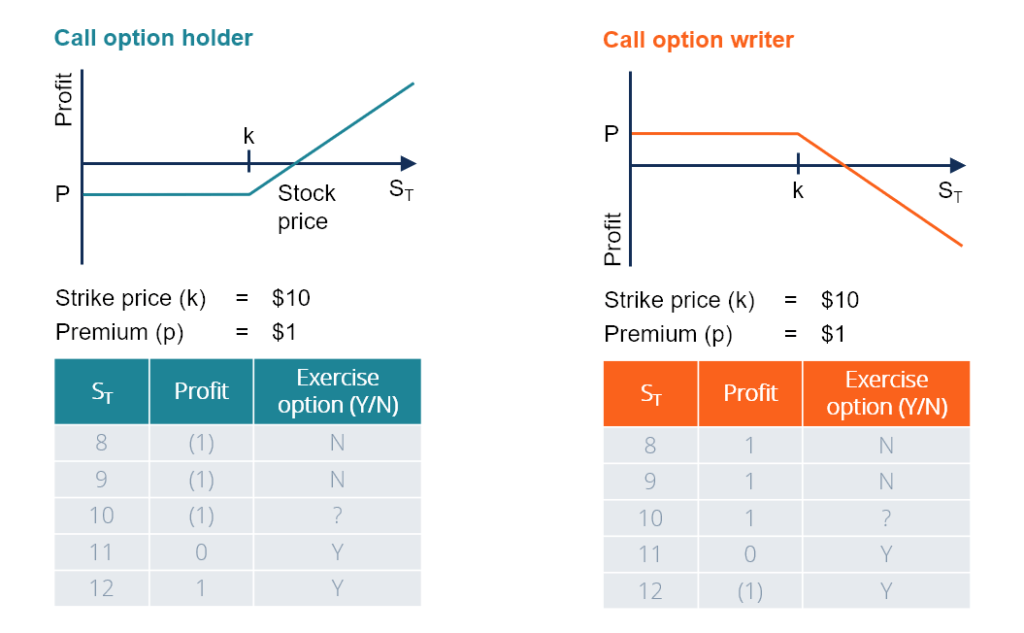

Call option profit formula

The buyer of the call option has no upper limit on the potential profit and a. See visualisations of a strategys return on investment by possible future stock prices.

How And Why Interest Rates Affect Options

The price of the underlying asset increases to 130 per share.

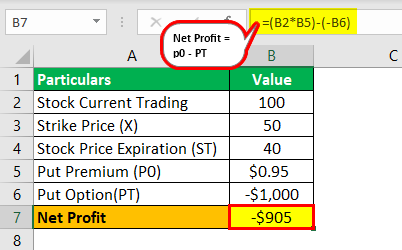

. Calculating Call And Put Option. Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900. The value of this call option can be calculated as.

An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Breakeven BE strike price option premium 145 350 14850 assuming held to expiration The maximum gain for long calls is theoretically unlimited regardless of the. Purchase of three 95 call option contracts.

To calculate how much this is in bitcoin you divide. The buyer decides to exercise the call option and purchase the sellers shares. The Profit at expiry is the value less the premium initially paid for the option.

To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100. The breakeven price is equal to. Calculate the value of a call or put option or multi-option strategies.

Example 5 ITM long call option. 10000 8000 2000. Profit for a call seller max0ST Xc0 m a x 0 S T X c 0 where c0 c 0 the call premium.

To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100. Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is 50. To convert this figure into a percentage value reflective of total return divide the profit by the total purchase price of the asset and then multiply the resulting figure by 100.

In this case the seller would earn. Free stock-option profit calculation tool.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Short Call Definition

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

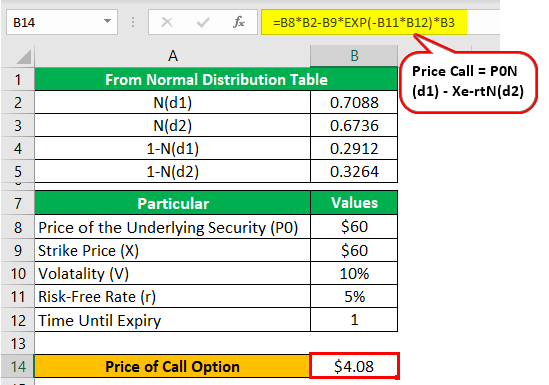

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Understanding Synthetic Options

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Short Call Definition

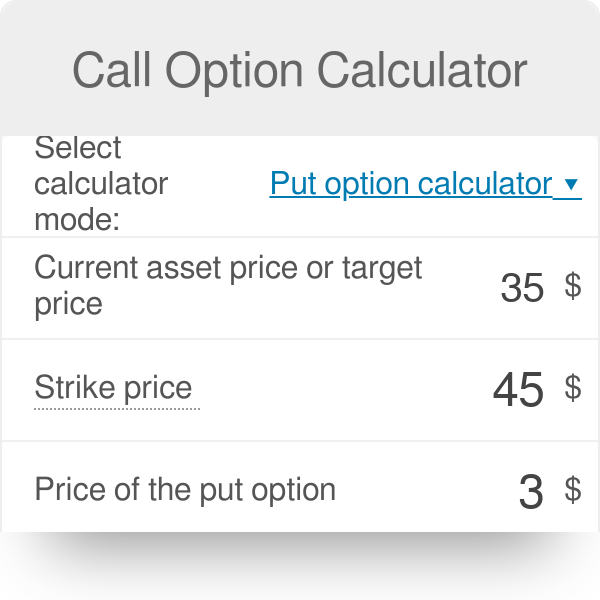

Call Option Calculator Put Option

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png)

The Importance Of Time Value In Options Trading

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

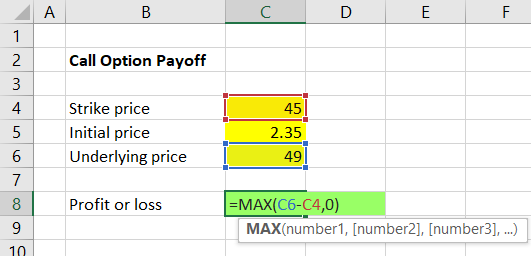

Calculating Call And Put Option Payoff In Excel Macroption

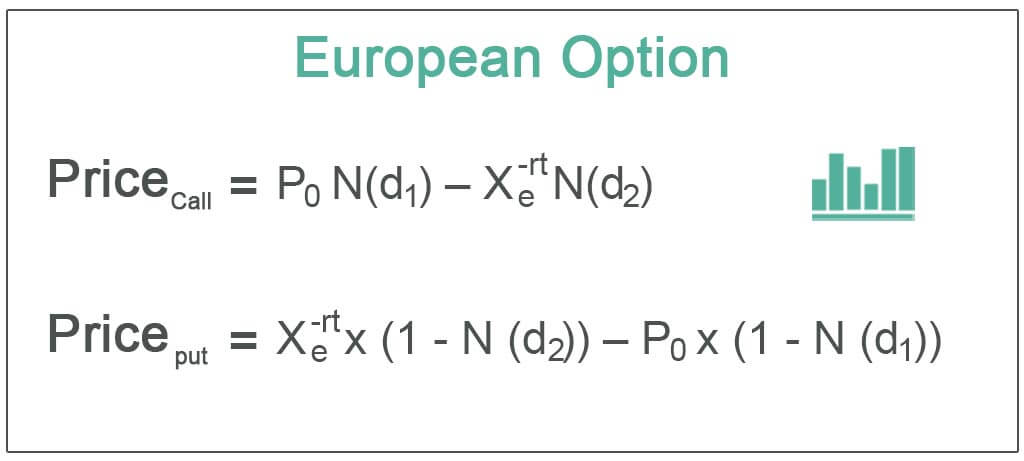

European Option Definition Examples Pricing Formula With Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

Call Option Understand How Buying Selling Call Options Works

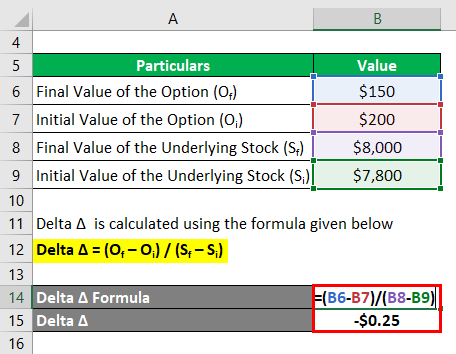

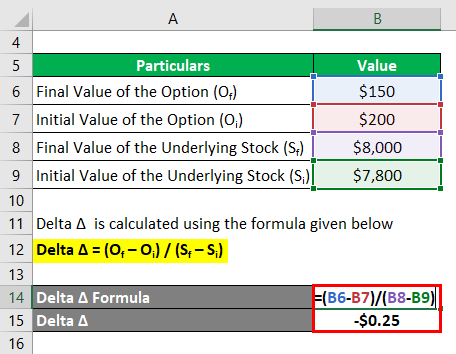

Delta Formula Calculator Examples With Excel Template

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-03-34c346d142194e909757661f6cdcd95a.jpg)

Vertical Spread Definition

Put Options Definition Types Steps To Calculate Payoff With Examples

/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Understanding Synthetic Options